Opinion: Higher taxes are on the horizon. Don’t let them spoil your retirement.

Opinion: Higher taxes are on the horizon. Don’t let them spoil your retirement.

- September 9, 2024

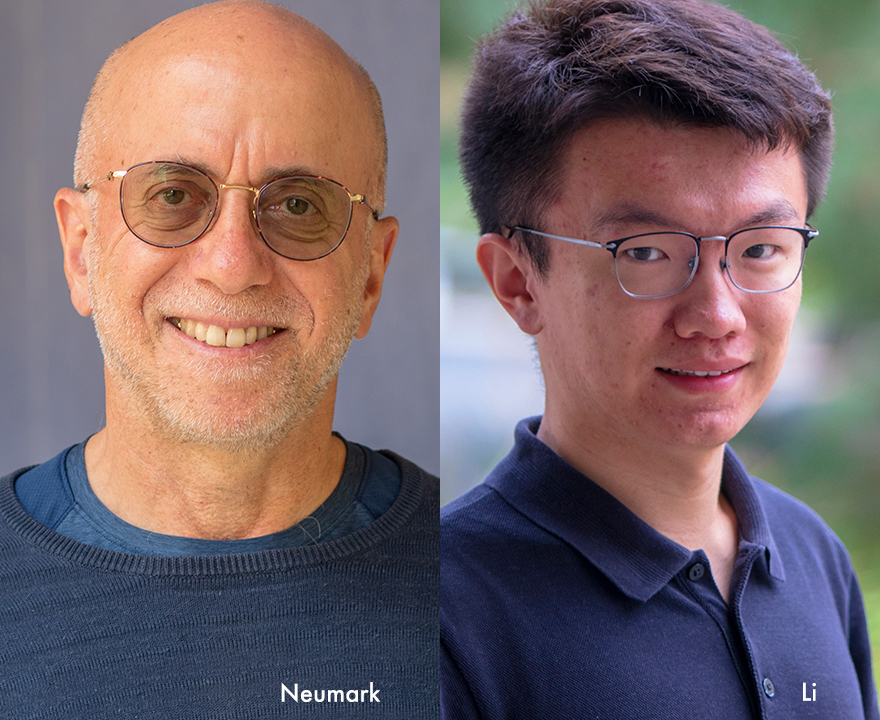

- Research by David Neumark and Zeyu Li, economics, in The New York Times, Sept. 9, 2024 (Opinion)

-----

California’s generous supplement to the federal government’s earned-income tax credit is poorly designed, a new study says. California provides the biggest supplement of any state to its lowest-income workers. But the credit — which is intended to make working more remunerative — has no effect on the employment of less-skilled single mothers, according to the paper by David Neumark and Zeyu Li of University of California, Irvine. California’s supplement phases out rapidly as income rises, so it discourages recipients from earning more money, Neumark and Li found.

For the full story, please visit https://www.nytimes.com/2024/09/09/opinion/retirement-higher-taxes-deficit.html.

-----

Would you like to get more involved with the social sciences? Email us at communications@socsci.uci.edu to connect.

Share on:

Related News Items

- Careet RightRaising the minimum wage actually increases racial disparities

- Careet RightHeadquarters are leaving CA. What does this mean for our economy?

- Careet RightExperts answer: Are headquarters really fleeing California?

- Careet RightHigh-profile companies moving out of California

- Careet RightExempting tips from taxes could hurt employees, critics say